Don’t Panic, Prepare for Opportunities Before They Materialize

One thing is certain in the swine industry: we can always rely on volatility to change things in a very short period of time. In mid-March, the June hog futures contract went from $102 to $88. In less than a two-week period, projected margins for the next 12 months went from $14 a head to minus $6. It’s rare to see that quick of a deterioration unless an extraordinary event transpires.

After having discussions with several producers, they’re wondering if this is the next disaster in the making for the industry. I have my doubts. I am not saying this downturn will not be difficult, but when looking back at history, there have been extenuating circumstances that have been the driving force behind those challenges.

A Look Back

In July 1998, Thorn Apple Valley closed and the industry lost a packing capacity of 14,000 head per day. The plant closure was the main driver behind the industry hog production exceeding plant capacity later that fall and prices falling that December to $8 per hundredweight (cwt).

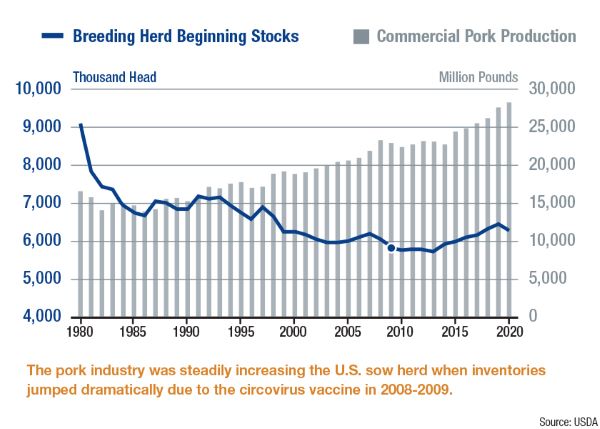

In 2008 and 2009, the industry had limited packing capacity due to the introduction of the circovirus vaccine. Prior to that, we had a steady increase in productivity and, up through 2007, we continued to increase the sow herd. As illustrated below, we were on a steady pace of increasing the U.S. sow herd and inventories jumped dramatically due to the circovirus vaccine. However, with a new vaccine available and growth in the industry, we pushed production to limits that exceed capacity. In 2009, H1N1 was also reported in the U.S. Prices and demand dropped sharply as consumers were afraid that consuming pork could potentially infect them.

By 2009, the pork industry was on the brink of financial failure. This was the worst position I have seen the industry in during my career. Unfortunately, some producers were forced out of business due to owners unwilling to risk additional capital or unable to continue to fund losses.

The most recent challenge came in 2020 as plants were closed due to COVID-19 and hogs were backed up on farms. As shelves emptied in the grocery stores, plants were temporarily shut down and producers were pushed to the brink trying to figure out what to do with market hog inventories.

A Look Ahead

Looking at current USDA reports, sow numbers show a slight increase of the sow herd over last year. However, the herd is still lower than 2018 prior to the Seaboard Triumph plant being double shifted and the Prestage Foods plant coming online in 2019.

High grain markets have driven up inventory costs which has consumed working capital for operations, and losses in the fourth and first quarters are adding to balance sheet strains. My recommendation is that you have at least $600 per sow working capital for your operation at all times. Even in a rising interest rate environment, if you haven’t already looked at leveraging your fixed assets for your farm, it’s something you should consider.

It’s important to create working capital for your business before you need it. As the old saying goes, “when you are in the woods and a bear appears, you don’t have to be the fastest runner, only faster than those around you!” Now is not the time to panic, but rather it’s time to prepare yourself to take advantage of opportunities when they do materialize.

More from Farm Journal's PORK:

USDA's Hogs and Pigs Report is ‘Sharply Neutral,' Flory Says

A Multidimensional Approach to Sustainability in the Swine Industry

Producers Slam on the Brakes: Analysts Weigh in on USDA Hogs and Pigs Report