Bullish Hogs and Pigs Report: Producers Are Keeping Supply in Check

The bullish September Hogs and Pigs Report indicates producers are keeping production at a level that meets consumer demand, said Altin Kalo, chief economist at Steiner Consulting in Merrimack, N.H.

“We’ve seen in other years an irrational expansion that hurts the whole industry. The fact that we are keeping the supply in check given all the uncertainty out there – especially the increasing costs – I think that’s positive for producers,” he said.

The breeding herd is one of the better numbers in this report, but he says a big question mark remains as to what will happen with Proposition 12 and how requirements from California and Massachusetts could affect production.

Kalo shared his reactions to Sept. 1’s USDA’s Hogs and Pigs Report during a webinar hosted by the National Pork Board and the Pork Checkoff on Sept. 29.

First, a Look at the Numbers

The total inventory for all hogs and pigs on Sept. 1 was 73.8 million head. That’s down 1% from a year ago, but up 2% from June 1. The report also showed:

- Market hog inventory on Sept. 1 was 67.6 million, down 1% from 2021, but up 2% from the previous quarter.

- Total number of hogs under contract owned by operations with over 5,000 head, but raised by contractees, accounted for 50% of the total U.S. hog inventory, up 1% from 2021.

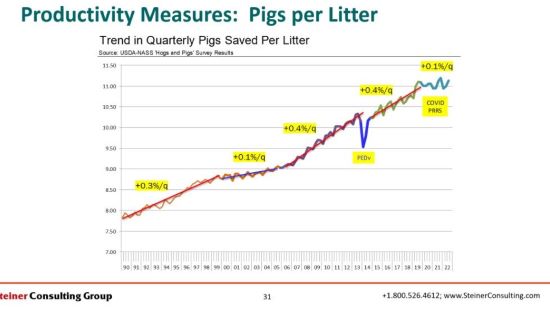

- Breeding inventory numbers came in at 6.15 million head, down 1% from a year ago and down slightly from June 1. The June through August 2022 pig crop, at 33.6 million head, was down 1% from 2021. The number of sows that farrowed during this three-month period was down 1% from 2021 at 3.02 million head, which represents 49% of the breeding herd. The average pigs saved per litter was 11.13 for the June through August 2022 period, unchanged from last year.

- U.S. hog producers intend to farrow 2.97 million sows during the September through November 2022 quarter, down 2% from the actual farrowings during the same period in 2021 and down 6% from the same period in 2020.

- Intended farrowings for December 2022 through February 2023, at 2.9 million sows, are down 1% from the same period in 2021 and down 1% from the same period in 2020.

The revision made to the March 2022 through May 2022 pig crop was 0.1%. A net revision of 0.7% was made to the December 2021 all hogs and pigs inventory. A net revision of 0.7% was made to the March 2022 all hogs and pigs inventory. The net revision made to the December 2021 through February 2022 pig crop was 0.6%.

What’s the Implication for Production?

In the previous year, the pork industry has seen fewer hogs come to market. Kalo said this is a function of the smaller breeding herd and a function of lower productivity due to herd health challenges.

Throughout the last 12 months, the industry has seen increases in the breeding herd in the South and certainly parts of the Midwest. But it’s also seen reductions, Kalo points out, especially out West.

“Overall, the breeding herd right now is about 38,000 head less than it was a year ago at this time. That's important because it's going to affect what the numbers are for the September to November time period and future quarters,” he said.

Productivity is not going in the right direction and it's something Kalo said producers are going to have to work on in order to improve herd health. The other piece of that is the number of pigs saved per litter.

Good News for Consumers

For consumers, Kalo said the big message from this report is there will be plenty of pork going into the holidays.

“We’re going to be slaughtering 2.6 million hogs a week, relatively the same or a percent more than last year. There is plenty of pork in the pipeline at prices that could help bring what used to be price inflation at retail.”

But as we look forward, in order to give producers a reason to expand and bring more pork to market, we need to reduce barriers.

“The uncertainty remaining with Prop 12, in my mind, is something we should all be concerned about because all it does is increase costs for everyone. So, short term, we should have plenty of pork, but we have some big question marks for 2023 depending on those exports.”

Mexico: A Bright Spot in the Export Market

Mexico is helping keep the U.S. ham market firm, he adds.

“It's been extremely firm in part because Mexico is buying significant volumes. They still prefer to buy U.S. pork,” Kalo said. “It's a relatively inexpensive protein for them. Some other currencies have lost a lot of value versus the U.S. dollar, but not the peso.”

In addition, due to the avian flu outbreak, Kalo is seeing very strong demand from retailers getting ready for the fourth quarter because there will be a significant shortfall of turkeys for that period.

“The demand for hams is very strong. I think the industry is still positioned to supply the market pretty well through the fourth quarter,” Kalo said.

More from Farm Journal's PORK:

USDA's Latest Hogs and Pigs Report Gave Producers A Hint About What To Expect In Q4

Lower Slaughter Numbers Drive Pork Prices Higher

Top 10 Hogs and Pork Outlook Highlights in August 2022