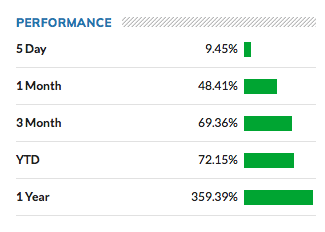

Labor Shortage, Wet Weather Cause Lumber Prices to Surge 359%

USFR- Surging Lumber Prices 05.01.21

As shoppers face sticker shock when buying lumber, prices continue to climb. Lumber prices are up 359% since last year at this time, with a 69% increase taking place since the start of 2021. But the higher prices aren’t trickling down to producers.

“Unfortunately, not; if you look at it from the stumpage and delivery, prices are very hyper local,” says Jonathan Smith, executive director of TimberMart-South.

TimberMart-South is a timber price reporting service that covers pricing from eastern Texas to the Southeast.

“If you look at it from a South-wide level, your stumpage prices are up about 2.5% year over year,” Smith adds.

Smith says with a hyperlocal market, as you move farther south to southern Georgia, producers there are seeing stumpage prices up 12% year over year. The increase is still a far cry from the 359% surge in lumber prices, a scenario that’s leaving even industry insiders stumped.

“That's a good question,” Smith says, when asked why lumber prices are skyrocketing. “I think probably that'll be in the economics books in the future. There's a lot of market stuff that's going on right now.”

Smith says inventories were tight leading into COVID-19, but he says there’s still a lot of wood available today.

“There's a lot of timber on the stock, inventory growth to dry,” says Smith. “We're good at doing what we do in the South. We are growing more than we're harvesting on an annual basis.”

For David Mercker, University of Tennessee Extension forester, it’s a complex issue that boils down to one main economic principle.

“From a broad perspective, it's fairly simple as with all commodities; it's a supply and demand issue,” says Mercker.

While there are a lot of standing trees, Mercker says there’s an issue in getting that product processed.

“We have an ample supply of standing trees or timber,” adds Mercker. “But that doesn't necessarily correlate with an ample supply of lumber.”

Mercker says it boils down to three different bottlenecks, and it all starts with a labor shortage.

“There's an under-supply of labor at all levels in this industry, whether it's logging, mills or truckers,” says Mercker. “I spoke with a mill operator recently who said he hired five people, and he said one person showed up for work, and they worked for two days. So, that's a big issue.”

Mercker says the wet weather in the Southeast this winter also put a damper on harvest.

“And that makes it difficult for loggers,” he says. “They have to follow best management practices. And so, they can't just run up on the property and contribute mud to the waterways and so forth.”

The final issue he says deals with the byproducts. “Millers can’t get rid of sawdust and chips,” says Mercker.

“I spoke with one mill operator, he said he's operating at about 80% mill capacity because of all these obstacles that he's facing right now,” he says.

The one factor that’s not an issue is the number of trees available to harvest. An abundance of trees today sprouted from an increase in the conservation reserve program (CRP) more than a decade ago.

“If we can't produce enough wood because of labor shortages, then that's going to keep prices high,” says Mercker.

As the bottlenecks produce higher lumber prices, those in the timber industry say they hope higher prices don’t scare off demand.

“From that perspective, a lot has got to happen on the consumption side in order to get that in a balance like we were in the mid 2000s,” says Smith.

As the lumber industry tries to find a balance, the housing industry continues to explode.

“Nobody knows what the future will hold,” says Smith. “We don't know if this is a new normal, or if things will go back.”

Related Stories:

Continuing Coverage: Crop Protection and Ag Products in Short Supply