Competition Tightens for Pork Exports

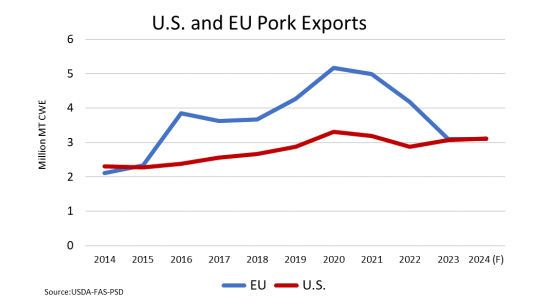

The revised 2024 forecast of pork shipments by U.S. and the European Union (EU), the world’s top two exporters, are nearly on par for the first time since 2015, the USDA’s Foreign Agricultural Service reported in the Livestock and Poultry: World Markets and Trade report.

U.S. and EU exports for 2024 are both revised lower compared to the October forecast in the latest report. But the gap is narrowed for these competitors as U.S. shipments are revised only 1% lower while EU shipments are revised 3% lower.

“The downward revisions for U.S. and EU exports are driven by expected weaker shipments to China, the world’s largest importer. Continued weak demand by China reduces export opportunities, particularly for the EU,” the report noted.

U.S. export volumes to China remain significant to total exports, but the U.S. share of exports to China is less than for the EU. In 2022, U.S. shipments to China accounted for 10% of total exports, while EU shipments to China accounted for 27% of total exports.

The report pointed out that EU’s production decline in recent years and 2% lower revision in 2024 tightens exportable supplies. Forecast growth in U.S. production and lower prices are expected to underpin U.S. exports competitiveness in several market.

Key highlights of the report include:

• Global pork production for 2024 is revised down 1% from the October forecast to 114.2 million tons on lower output in China, the EU and Brazil.

• China production is revised lower as continued weak demand discourages expanding domestic production.

• EU production is revised lower on continued regulatory pressure and changing consumer preferences.

• Brazil production is revised lower as imports from top market China continue to weaken.

• U.S. production is virtually unchanged with declines in the farrowings offset by increased pigs per litter.

• Global pork exports for 2024 are lowered 2% from the October forecast to 10.2 million tons as the EU, U.S., and Brazil increasingly compete for lower China imports.

• Although U.S. exports remain strong to many core markets, including Mexico and Canada, aggregate exports are revised lower against weak import demand from Japan and China.

• United Kingdom exports are also revised lower on declining demand from the European Union.

Read the full report here.