Natural Gas Prices Only Account for 15% of Run-Up in Anhydrous Ammonia Prices, Shows New Texas A&M Study

Fertilizer prices and availability could be the deciding factors in farmers’ acreage decisions in 2022. Texas A&M Agricultural and Food Policy Center (AFPC) released a second economic impact study this week — this one focused on what's causing the spike in nitrogen prices and the resulting impact on input costs for corn producers.

Why Are Fertilizer Prices So High?

The “Economic Impact of Nitrogen Prices on U.S. Corn Producers” report was prepared for 21 state corn grower groups. Chris Edgington, an Iowa farmer and president of National Corn Growers Association (NCGA), says fertilizer prices are the top issue and concern for NCGA members right now.

|

| Graphic Courtesy of Lindsey Benne; Data Provided by AFPC Texas A&M Fertilizer Price Study for Corn Growers |

“One of the things we're really trying to figure out is why prices have gone up so much,” he says. “Corn prices are up 50% but nitrogen fertilizer is up 150%, maybe more. In fact, [nitrogen] is more now compared with when the study was done. That's a big economic decision maker when there's a shift in the price of one of our inputs. It will influence whether a farmer plants corn, soybeans or wheat, and what their overall crop mixture is for this next year.”

The Role of Natural Gas in Nitrogen Prices

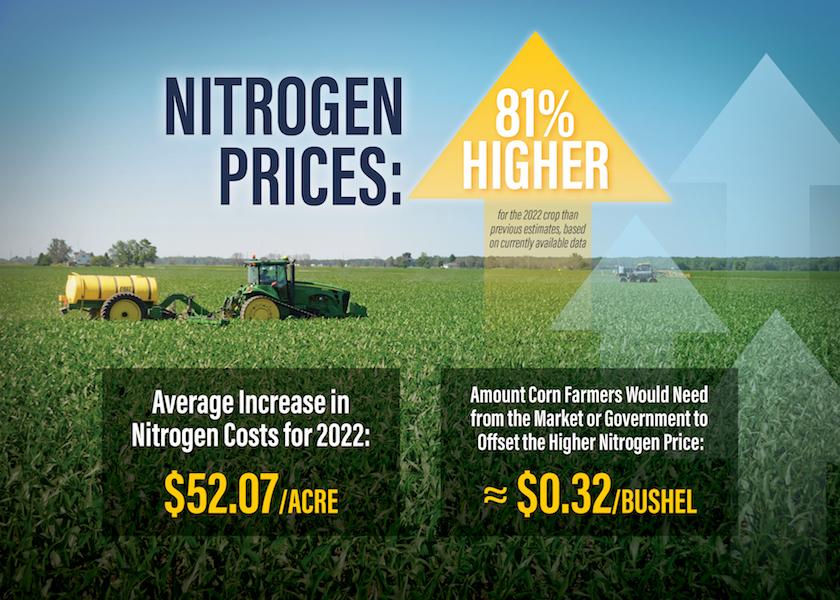

In another fertilizer economic impact study released earlier this week, AFPC was asked to analyze the impact of higher nitrogen prices on 64 representative crop farms by a member of Congress. The report found, “based on currently available data, the increase in nitrogen prices appears to be 81% higher for the 2022 crop than previous estimates.”

On a per-acre basis, AFPC economists say farmers are seeing nitrogen costs increase $52.07 across the farms they use in their modeling.

“This means corn farmers need roughly 32¢ per bushel from the market or government to offset the higher nitrogen price,” according to the report.

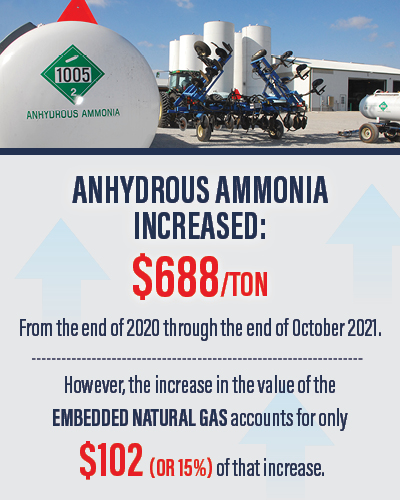

“This study was largely led by my co-director, Dr. Joe Outlaw, but once we started to back out the cost of natural gas, we found that only explains about 15% of the price increase over the past year,” says Bart Fischer, AFPC co-director. “Most folks, I think, would be surprised by how small of a role natural gas is playing because we hear a lot about those dynamics and that natural gas is driving it. This report puts that in context at roughly 15%, which then raises a lot of questions about well, then what else is driving it?”

Anhydrous Ammonia Prices Highest Since 2008

Other key findings in the AFPC report on the Economic Import of Nitrogen Prices on U.S. Corn Producers include:

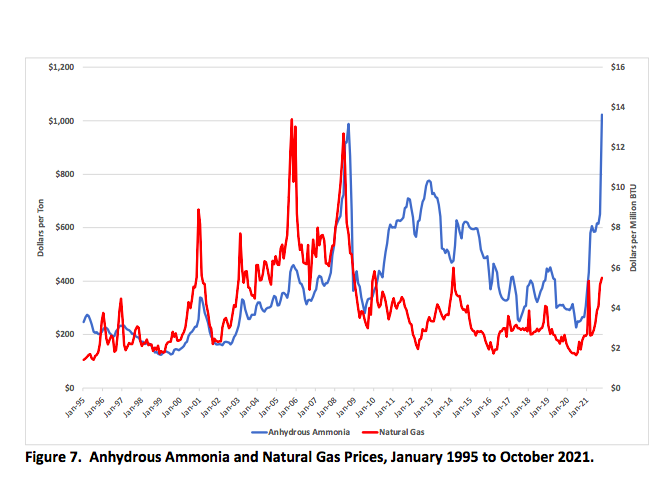

- Nitrogen prices experienced significant peaks in July 2008 and throughout 2021. U.S. anhydrous ammonia prices fell to $226.50 per ton in June 2020 before steadily increasing to $432.50 per ton in February 2021. In March 2021, anhydrous ammonia prices increased 34% to $580 per ton. Since that time, prices have steadily risen to $1,022.50 per ton by October 2021 — the highest levels since 2008.

- The suggestion that recent increases in the price of natural gas are the primary reason for increases in the prices of nitrogen products is highly suspect.

- For example, the price of anhydrous ammonia increased $688 per ton from the end of 2020 through October 2021. However, the increase in the value of the embedded natural gas accounts for only $102 (or 15%) of that increase. Once the value of natural gas in a ton of anhydrous ammonia has been subtracted from the anhydrous ammonia price, the residual tends to closely track the price of corn, albeit on different scales.

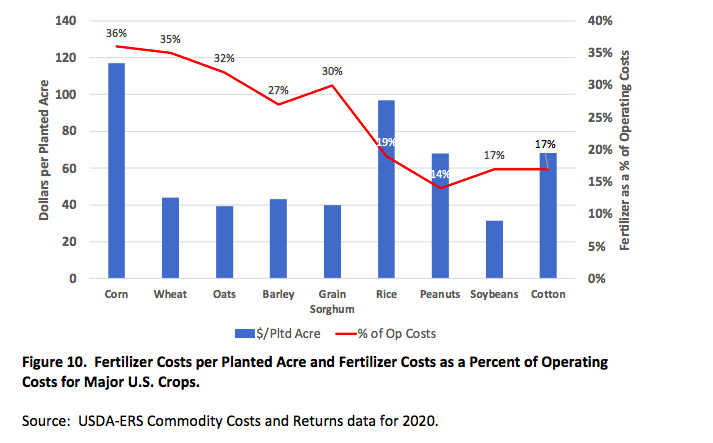

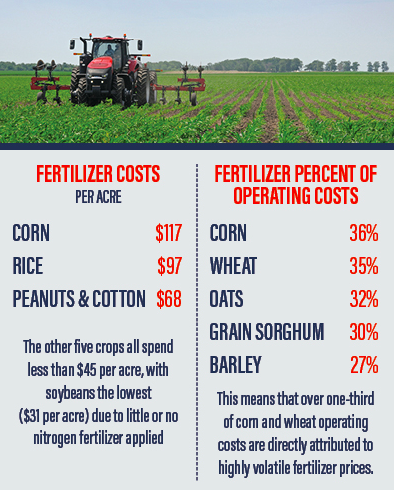

- Fertilizer is a major cost for corn producers with nitrogen accounting for more than 50% of the cost. Corn has the highest fertilizer cost at $117 per acre followed by rice at $97 per acre and peanuts and cotton at $68 per acre. The other five crops spend less than $45 per acre, with soybeans the lowest at $31 per acre.

- Fertilizer costs for corn (36%) account for the highest percentage of operating costs across the nine commodities followed by wheat (35%), oats (32%), grain sorghum (30%) and barley (27%). This means more than one-third of corn and wheat operating costs are directly attributed to highly volatile fertilizer prices.

Six Factors Driving Fertilizer Prices

So, what is driving the run-up in fertilizer prices over the past year? The Fertilizer Institute points to six major factors: global demand for fertilizer; recent weather events impacting domestic production; production plant maintenance pushed back due to COVID-19; international geopolitical issues, including in Belarus and China; transportation costs; and the cost of natural gas.

“There is uncertainty with the supply chain, logistics and everything else involved. I know there are growing concerns about the role tariffs may or may not play in this as well because there are a couple of ongoing cases with respect to the United States potentially placing tariffs against companies from other countries,” Fischer says. "I think one concern we acknowledged in the report, though, is there's a lot of unexplained factors and certainly the one that's thrown around the most, natural gas, does not appear to be a huge motivating factor. It does then start to raise questions about what else is going on?”

AFPC’s study shows farmers are currently facing nitrogen costs 80% higher than last year. That's as anhydrous ammonia prices reached 2008 levels in October at more than $1,000 per ton. And those prices have been steadily rising ever since.

“You're talking fertilizer prices that have gone up somewhere close to $200 an acre for some producers, and the revenue being generated is not offsetting that. And that's just the fertilizer industry,” Edgington says. “That’s not even talking about the chemistry industry, land values or equipment that people can't get. There is a big, big cash flow crunch coming. The banking industry is nervous about it as well, as they watch what has been a pretty good year for agriculture possibility go completely backward in this next growing season in a big way.”

|

| Graphic Courtesy of Lindsey Benne; Data Provided by AFPC Texas A&M Fertilizer Price Study for Corn Growers |

Edgington says the study reinforces the fact shell-shocked farmers can’t handle more price increases. That’s why NCGA says it’s urging CF Industries and Mosaic to withdraw petitions that led to the tariffs to the tune of 19% on imported fertilizers. NCGA, along with several other commodity groups, have filed a case with the U.S. Court of International Trade. A ruling is expected this year.

“We understand some of the risks we take in agriculture, but when people are asking for tariffs on top of what is already a price that is not acceptable for farmers to be able to try to make a living we have some problems with that,” says the NCGA president. “That's why we're pushing back. It's these tariffs. It's companies that are using trade wars and tariffs that's affecting us, individual farmers, as we try to make day-to-day decisions. It will have an impact. There will be less fertilizer put on, crop mix will change but to what level depends on supply.”

The study was commissioned by state corn organizations in Texas, Missouri, Colorado, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Maryland, Michigan, Minnesota, Nebraska, New York, North Carolina, North Dakota, Ohio, South Carolina, South Dakota, Tennessee and Wisconsin.

Mosaic Responds to Fertilizer Price Concerns

Mosaic recently commented on the fact some fertilizer prices are at 10-year highs. As reported in "The Scoop," Mosaic says with high global demand the supply chain disruptions have led to uncertainty and market instability. The company also emphasizes that fertilizer is a global market, and no one actor can determine the market because several factors have contributed to the rise in prices.

“We frankly empathize with the conundrums facing ag retailers and their customers – the growers,” says Andy Jung, director, market & strategic analysis at Mosaic. “Costs have escalated dramatically. There have been shipping delays. We talk to them regularly and understand the challenges across the input supply chain.”

Mosaic says the cost of energy particularly can affect their production of phosphate products due to their use of ammonia, which has increased in price as a raw material by 288%. Also, sulfur is up 165%.

Exploring the Impact Fertilizer Prices Have On Farmers

A separate report by AFPC released Monday shows supply chain disruptions are wreaking havoc on nitrogen, potassium and phosphorous prices, costing feedgrain farms the most.

AFPC conducted an economic impact study on fertilizer prices at the request of U.S. Rep. Julia Letlow (R-La.).

The study, which used a conservative estimate of a 50% rise in fertilizer costs, found several key points, including:

- As the nation struggles to recover from the COVID-19 pandemic, a number of supply chain disruptions continue to wreak havoc on agricultural input markets, both in terms of availability and cost of inputs. In the case of fertilizer, prices have exploded over the past year.

- Under FAPRI’s August 2021 baseline outlook, nitrogen prices were expected to increase about 10% in 2022. Based on current spot market prices, it appears as though fertilizer prices will increase in excess of 80% for the 2022 planting season (relative to 2021).

- The report found that the largest whole-farm impact would fall on AFPC’s feedgrain farms at an average of $128,000 per farm.

- The largest per-acre impact would fall on AFPC’s rice farms at $62.04 per acre

While the economic study from Texas A&M shows higher fertilizer prices are dampening the net farm income outlook for 2022, possible policy solutions are also something AFPC economists explored in the study. While the economists didn't outline set solutions, they did provide perspective, saying current farm bill safety nets aren't designed to handle a sudden increase in costs. If Congress or USDA opted to go the route of direct payments, AFPC found the spike in fertilizer costs across all farms equates to an added production cost of $42 per acre.