Cash Weaner Pig Prices Average $46.62, Down $5.07 Last Week

This market update is a PorkBusiness.com weekly column reporting trends in weaner pigs. All information contained in this update is for the week ended Mar. 17.

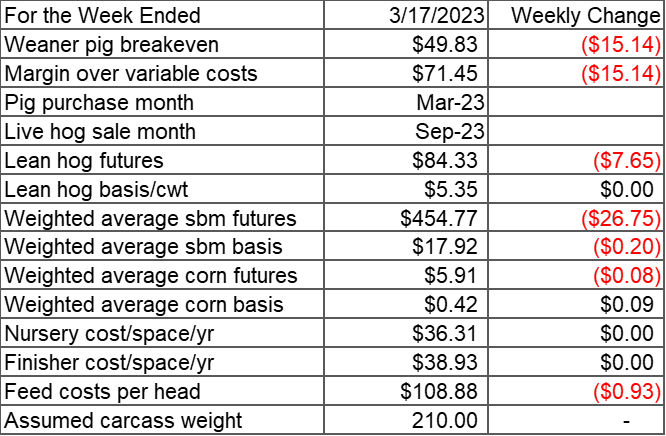

NutriQuest Business Solutions publishes weekly weaner pig profitability calculations which uses industry representative production costs and futures pricing for lean hogs, corn and soybean meal, using historical basis assumptions, to establish approximate profitability and break-even pricing for the current sale or purchase of weaner pigs. Prices are based on closing futures prices on Mar. 17 and assumes CME Lean Hog Index cost and historical basis assumptions.

When you consider that today’s purchased weaner would be sold in September 2023 using October 2023 futures, the weaner breakeven was $49.83, down $15.14 for the week. Feed costs were down $0.93 per head, and October futures decreased $7.65 compared to last week’s futures, while historical basis is unchanged from last week.

The “weaner pig breakeven” is an all-in break-even considering fixed costs (e.g., housing and labor) that would be incurred by the buyer. However, many buyers of weaners have empty space and therefore will incur these fixed costs whether the buildings are stocked with weaners. For those producers with empty space, the maximum price a buyer could pay for a weaner pig and breakeven is the “margin over variable costs,” which is $71.45.

Note that the weaner pig profitability calculations provide weekly insight into the relative value of pigs based on assumptions that may not be reflective of your individual situation.

From the National Direct Delivered Feeder Pig Report

Cash traded weaner pig volume was below average this week with 33,151 head being reported which is 94 percent of the 52-week average. Cash prices were $46.62, down $5.07 from a week ago. The low to high range was $30.00 - $58.00. Formula priced weaners were down $4.02 this week at $48.83.

Cash traded feeder pig reported volume was above average with 10,110 head reported. Cash feeder pig reported prices were $88.55, up $0.12 per head from last week.

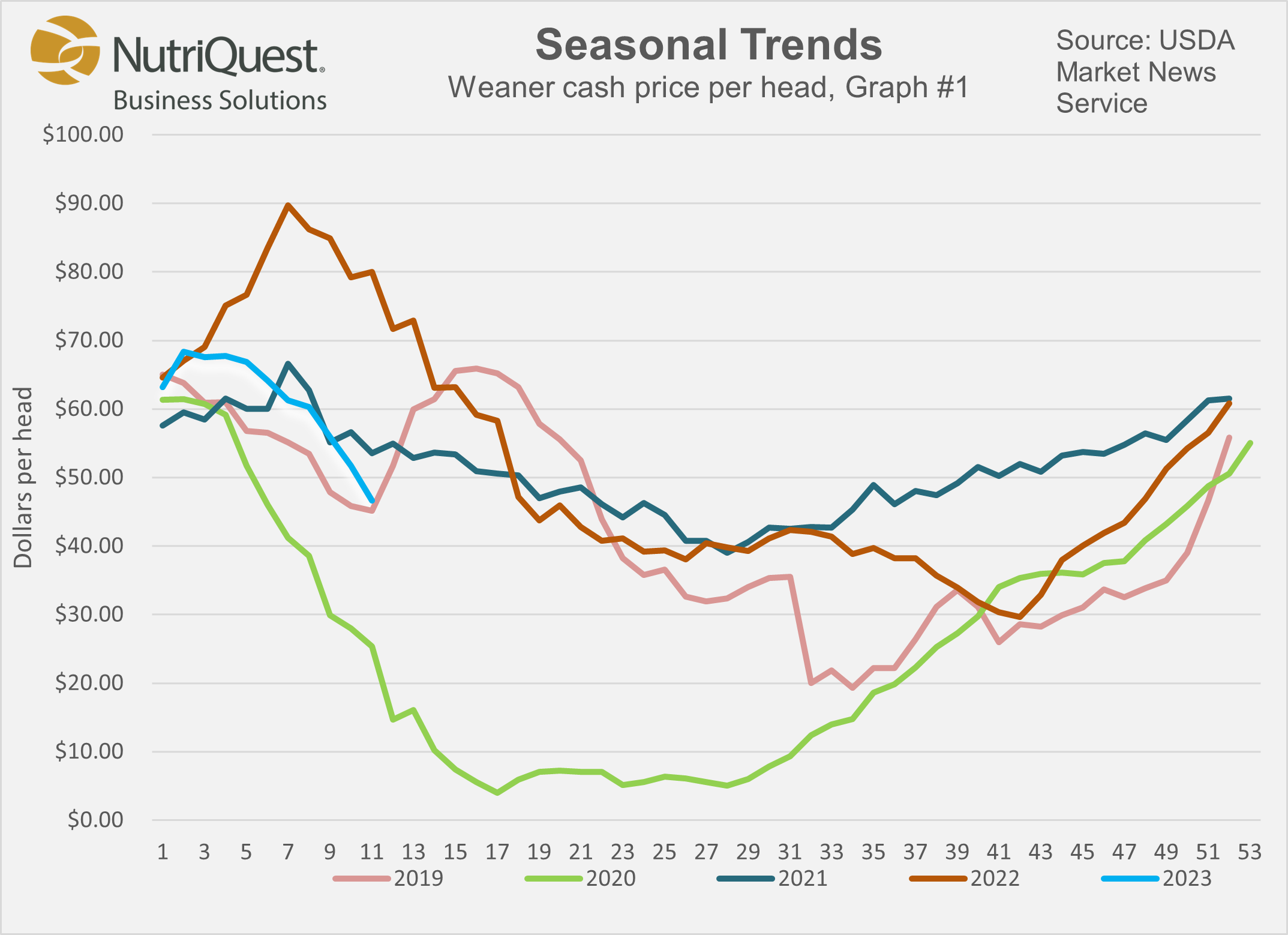

Graph 1 shows the seasonal trends of the cash weaner pig market.

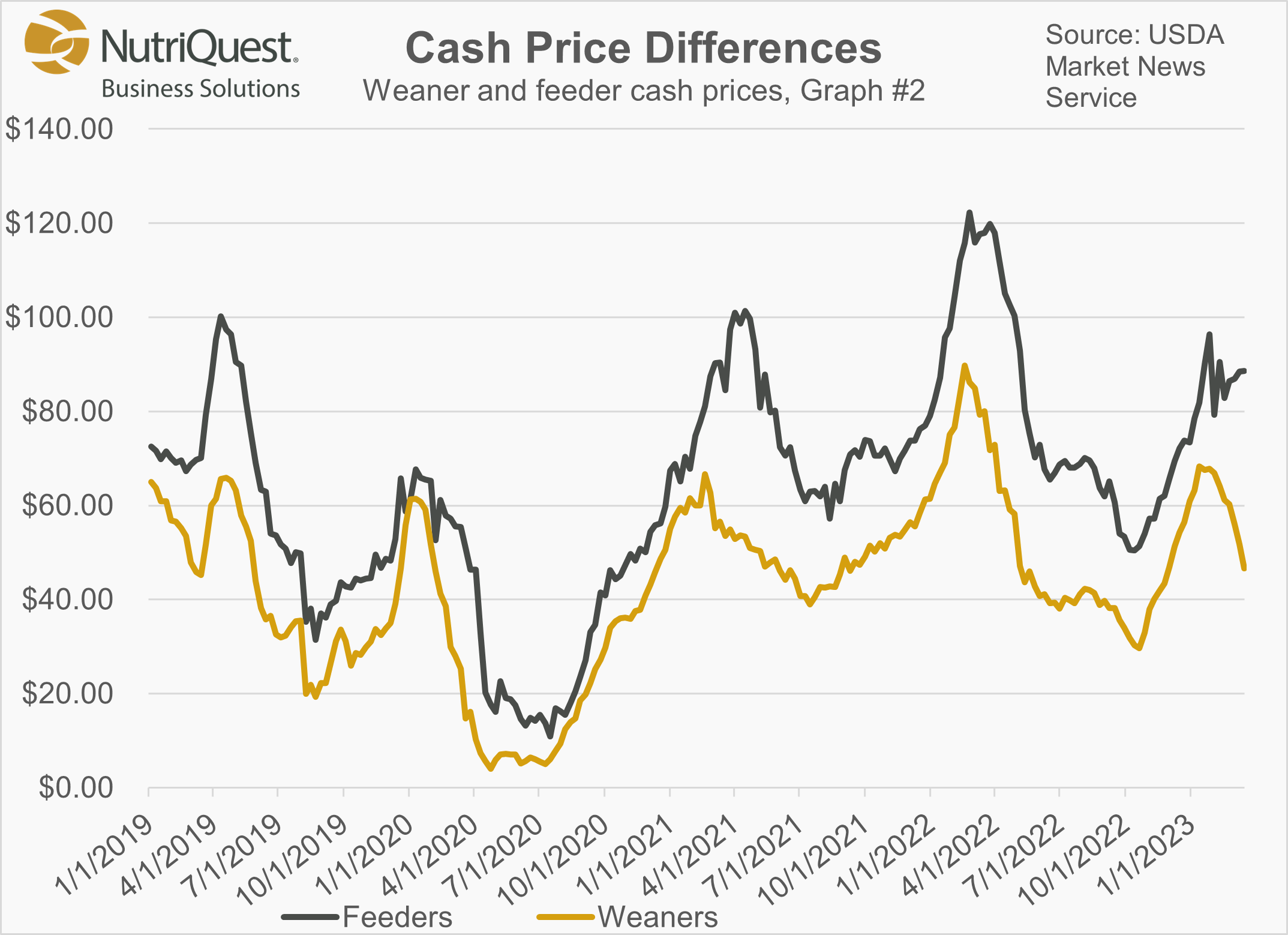

Graph 2 shows the cash weaner price and cash feeder price on a weekly basis through March 17, 2023.

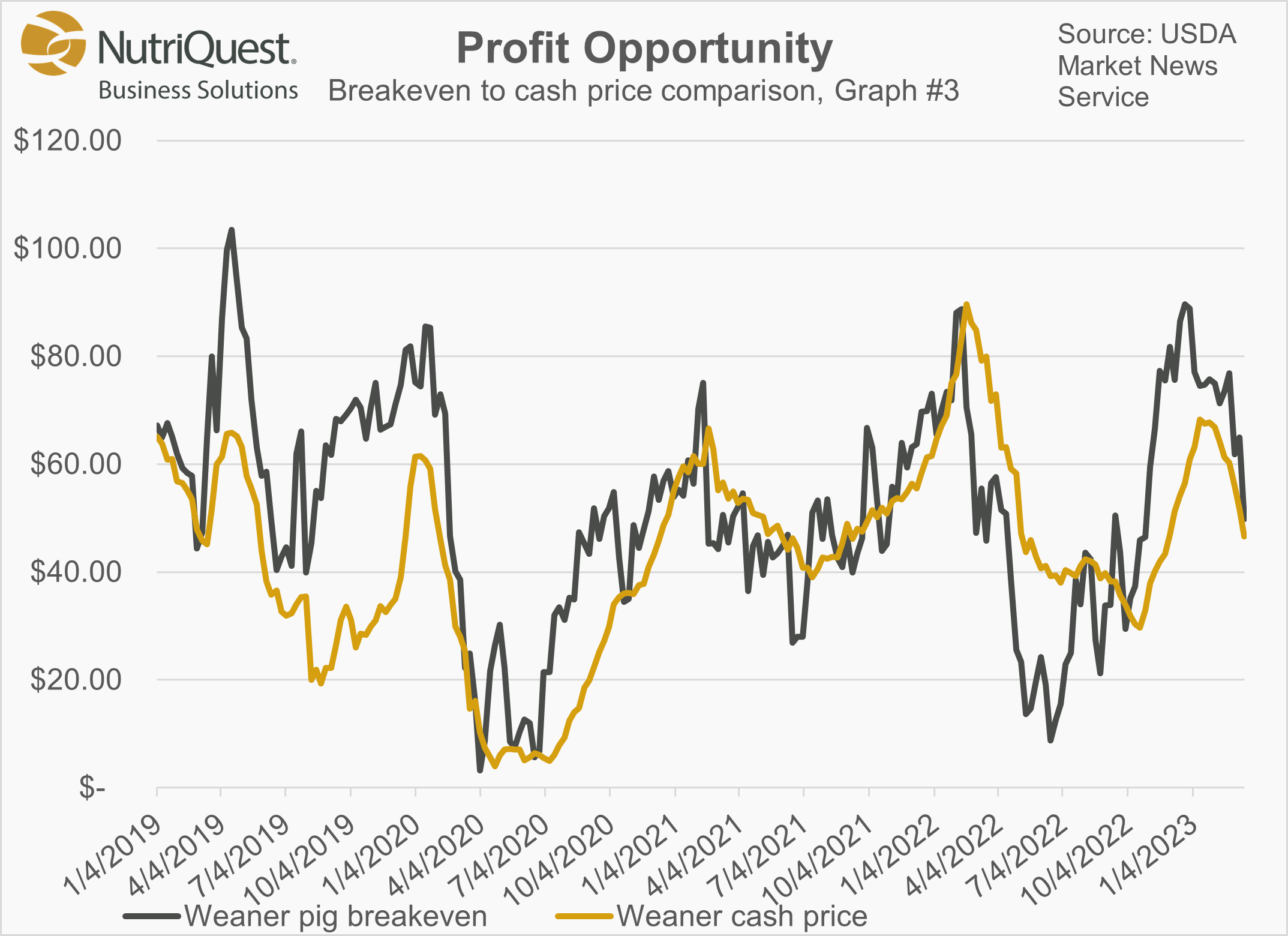

Graph 3 shows the estimated weaner pig profit by comparing the weaner pig cash price to the weaner breakeven. The profit potential decreased $10.07 this week to a projected gain of $3.21 per head.

Jennifer Brown is Director of NutriQuest Business Solutions, a division of NutriQuest. NutriQuest Business Solutions is a team of leading business and financial experts that bring years of unparalleled experience in the livestock, row crop and financial industries. At NutriQuest our success comes from helping producers realize improved profitability and sustainability through innovation driven by a relentless focus on helping producers succeed. For more information, please visit our website at www.nutriquest.com or email jenniferbrown@nutriquest.com.